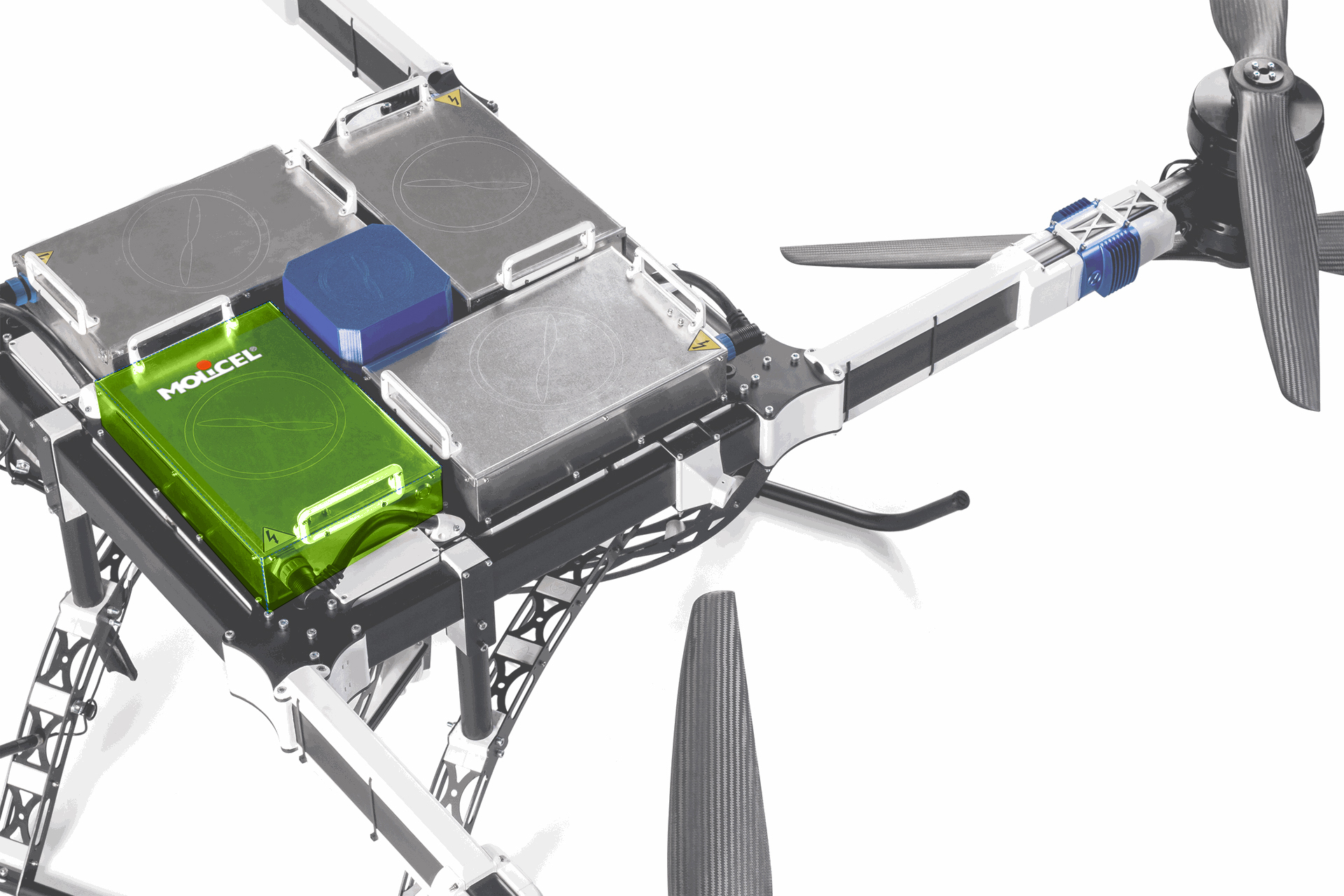

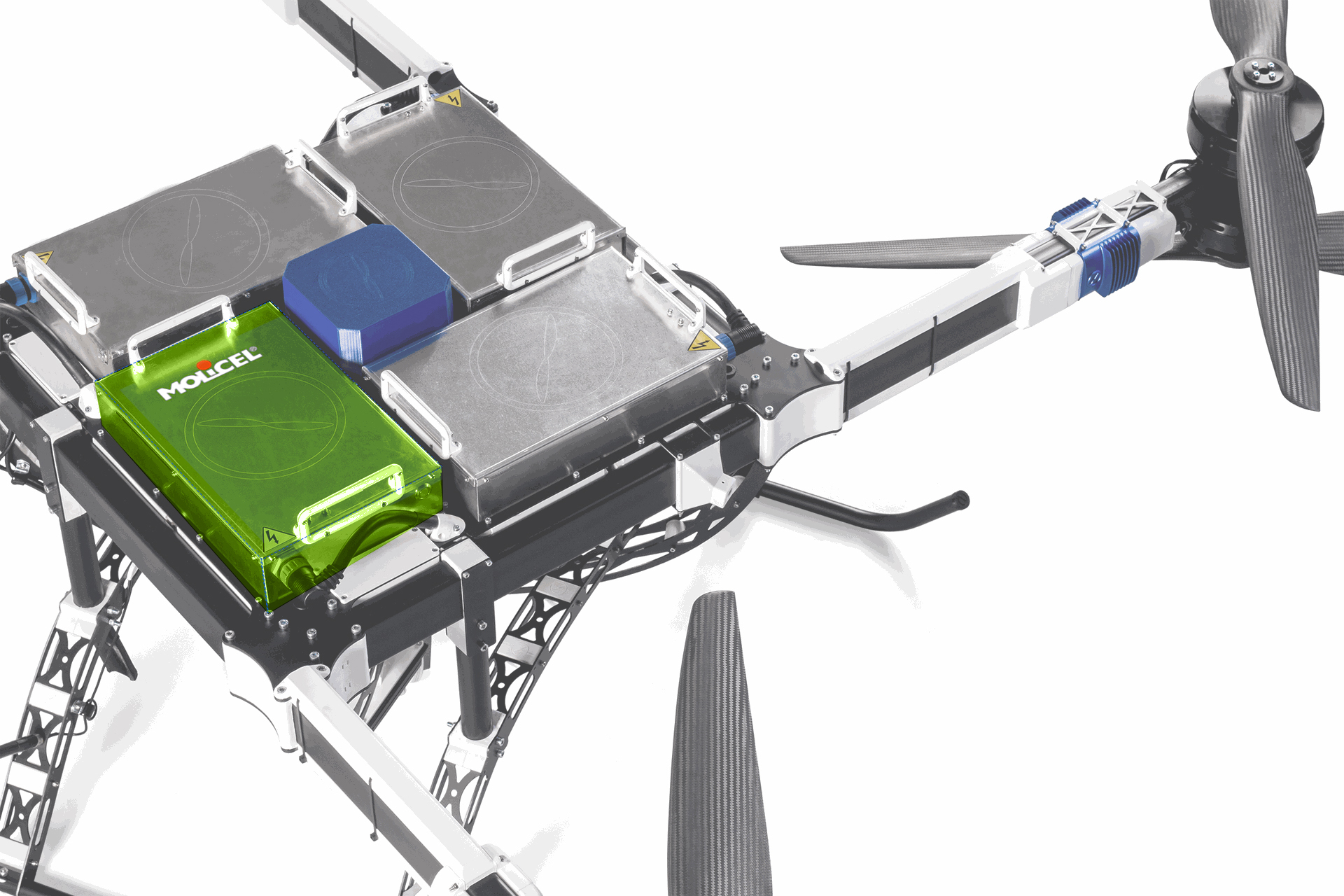

FlyingBasket, the leading European manufacturer of heavy-lift cargo drones, is excited to announce a strategic partnership with Molicel, a renowned innovator in lithium-ion battery technology. This collaboration aims to transform the cargo drone industry by developing advanced battery systems for FlyingBasket’s next-generation FB3 cargo drones.

Over the past two years, FlyingBasket and Molicel have worked closely to push the boundaries of drone battery technology by exchanging R&D prototypes not yet available on the market at the time, for performance testing and innovation purposes for developing better battery systems enhancing the performance capabilities of the FB3 aircraft.

This partnership will significantly enhance the capabilities of the FB3, a drone designed for extending the range of operations, particularly in the energy sector where offshore applications demand longer range and reliability. The new battery packs, composed of customizable lithium-ion cells, will allow the FB3 to achieve unprecedented performance. The new advanced batteries made of P50B cells will be tested and ready for deployment by July this year. This switch to cutting-edge technology will provide us with 9% more flight range for the full 100kg payload delivery, which will boost the operations, especially in energy and last-mile logistics.

“We are excited to continue to grow our partnership with Molicel, whose innovative approach and responsiveness to our needs have been critical to our progress,” said Moritz Moroder, CEO of FlyingBasket. “We already performed engineering validation tests and are currently working towards design validation. This partnership demonstrates the power of collaboration between pioneers in their respective fields, bringing transformative solutions to the market. ”

“We congratulate FlyingBasket on their success with drones. Their FB3 cargo drones demonstrate the world-class payload, flight range and safety provided by Molicel’s ultra-high-power battery technology. In the next generation, we will further enhance energy density and peak power for higher payload and greater reliability. We believe we will witness more drone advancements throughout the years,” said Casey Shiue, President of Molicel.

Molicel’s expertise in battery technology, combined with FlyingBasket’s leadership in drone manufacturing, highlights a commitment to advancing industry standards and creating sustainable, high-performance solutions. Powered by Molicel, the 21700 lithium-ion cell includes the INR-21700-P45B and INR-21700-P50B models for the low-impedance version. The P45B offers a 4.5Ah capacity, 240Wh/kg energy density, and ultra-fast 3C charging. The P50B features a 260Wh/kg energy density, over 400W power, and 5C ultra-fast charging, ideal for power and range demanding mobility applications.

About FlyingBasket. FlyingBasket is a leading drone manufacturer specialising in heavy-payload cargo drones that are commercially available today. With a focus on innovation and safety, FlyingBasket provides efficient and sustainable solutions for various industries, including energy, powerline stringing, logistics, and construction.

About Molicel. With over 40 years of expertise in rechargeable lithium-ion technology, Molicel is renowned for its high energy density and high power density cylindrical cells, which can provide great retention over long cycles. The company is the designated supplier for leading global brands in drones, electric sports cars, electric motorcycles, eVTOL, and heavy-duty tools.