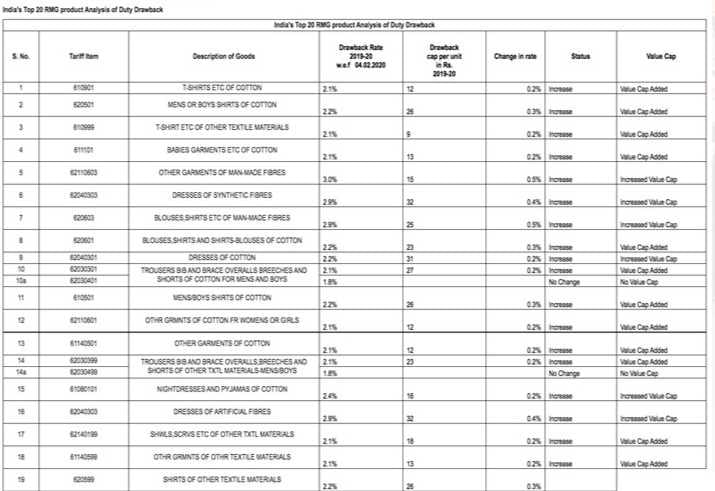

The new All Industry Rate of Duty Drawback to be made effective from 4 February 2020!

A notification in this regard was issued by Department of Revenue, Ministry of Finance. The drawback rates were keenly awaited and expected to be increased; however, there has been a marginal increase of 0.2 per cent to 0.5 per cent in major product categories.

In the new GST taxation regime, the drawback rate is only limited to the refund of the customs duty.

“We are thankful to the Government that the duty drawback rate for cotton grey yarn has been increased from 1.7 per cent to 1.9 per cent, for fabric from 1.6 per cent to 2 per cent, for made-ups from 2.6 per cent to 2.8 per cent, for apparels from 1.9 per cent to 2.1 per cent, thus encouraging value addition and benefiting the predominantly cotton-based spinning sector. We also appeal to the Government to remove the value cap for spandex yarn and certain categories of woven fabrics to encourage value addition,” Ashwin Chandran, Chairman, The Southern India Mills’ Association (SIMA).

The new rates start from 0.9 per cent and go up to 4 per cent as far as most of the textile and apparel products are concerned. With regard to few specific silk-based products, it is even 10.2 per cent (Cap of Rs. 4,987 per unit), which is maximum in textile category.

“The drawback rates were keenly awaited and expected to be increased; however, the drawback committee has kept the drawback rates same for most of the handicraft items, except glass artware where the rates have been enhanced ranging from 2.2 per cent to 4.8 per cent. For products like lace, there has been a marginal increase and there has been an increase in value cap in case of brass artware/copper artware/EPNS ware,” Rakesh Kumar, Director General, Export Promotion Council for Handicrafts (EPCH).

The notification also reads that the term ‘dyed’ in relation to fabrics and yarn of cotton, shall include ‘bleached or mercerised or printed or melange’. The term ‘dyed’ in relation to textile materials in Chapters 54 and 55 shall include ‘printed or bleached or melange’.

In respect of the tariff items in Chapters 60, 61, 62 and 63 of the said Schedule, the blend containing cotton and man-made fibre shall mean that content of man-made fibre in it shall be more than 15 per cent, but less than 85 per cent by weight and the blend containing wool and man-made fibre shall mean that content of man-made fibre in it shall be more than 15 per cent but less than 85 per cent by weight.

The drawback neutralises customs duty and excise duty component on the inputs used for products exported. This is offered at fixed rates independent of tax levied on inputs.